Portobello Company bought all of Strata Company's voting stock on January 1, 2020 for $20,000. Fair value information on Strata's assets and liabilities at the date of acquisition is as follows:

•Plant and equipment is overvalued by $5,000. P&E has a 10-year remaining life, straight-line.

•Previously unreported identifiable intangibles, meeting the criteria for capitalization, are valued at $7,000. These intangibles have indefinite lives, but testing reveals impairment of $800 in 2020.

•Goodwill reported for this acquisition is not impaired in 2020.

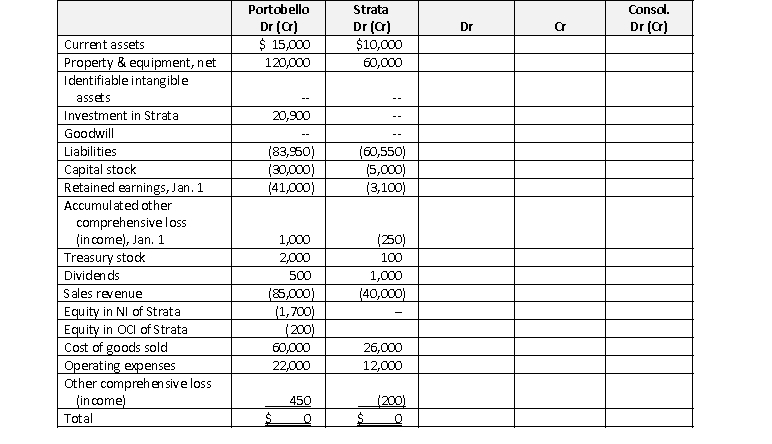

Portobello uses the complete equity method to account for its investment in Strata on its own books. Trial balances for both companies at December 31, 2020 are in the consolidation working paper below.

Required

Required

a. Calculate the initial goodwill recognized for this acquisition.

b. Calculate equity in net income, reported on Portobello's books, for 2020.

c. Fill in the working paper to consolidate the trial balances of the two companies at December 31, 2020.

d. Prepare, in good form, the 2020 consolidated statement of income and comprehensive income and the consolidated balance sheet at December 31, 2020.

Correct Answer:

Verified

Consolidated Statement of Income and...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q94: Photec Corporation acquires the voting stock of

Q95: A parent acquired the voting stock of

Q96: On January 1, 2019, Penn Corporation acquired

Q97: Prism Corporation acquires the voting stock of

Q98: Prism Corporation acquires the voting stock of

Q100: Portsdown Company bought all of Speedwell

Q101: Powerplan Industries bought Springfield Inc.'s voting

Q102: On January 2, 2018, Putney Industries

Q103: Playlink Corporation acquired the voting stock

Q104: Pyroplex Corporation acquires the voting stock of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents