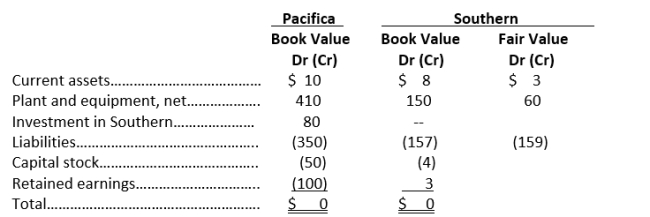

Pacifica Company acquires all the voting stock of Southern Industries for $80 million in cash, and accounts for the acquisition as a stock acquisition. Balance sheet information at the date of acquisition is as follows (in millions):

Southern has previously unreported identifiable intangibles with a fair value of $75 million. Southern elects to use pushdown accounting as of the date of acquisition.

Southern has previously unreported identifiable intangibles with a fair value of $75 million. Southern elects to use pushdown accounting as of the date of acquisition.

Required a. Prepare the entry Southern makes on its own books at the date of acquisition, using pushdown accounting.

b. Prepare the consolidation eliminating entry or entries necessary to consolidate the balance sheets of Pacifica and Southern at the date of acquisition.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q99: Mars Inc. acquired all of Wrigley

Q100: Dr. Pepper Snapple Group (DPSG) acquired

Q101: Packet Industries purchased all the voting

Q102: PLD Company purchased all the shares

Q103: Provo Company purchased all the shares

Q105: Parkside Company issued stock to acquire

Q106: Pebble Company pays $60 million in

Q107: The balance sheets of Publix Corporation

Q108: ADL Corporation issued 1,500,000 shares of

Q109: Pinoy Company acquired all the stock of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents