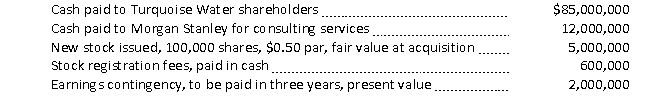

Dr. Pepper Snapple Group (DPSG) acquired the assets and liabilities of Turquoise Water Inc. on September 30, 2020, in a merger. The acquisition involves the following payments:

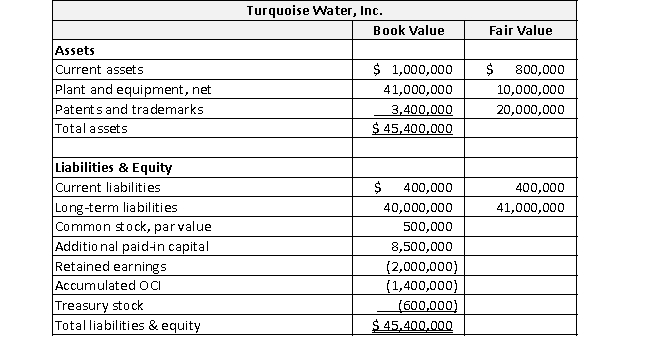

Turquoise Water's balance sheet just prior to the acquisition appears below. Fair value information on Turquoise Water's assets and liabilities is also provided.

Turquoise Water's balance sheet just prior to the acquisition appears below. Fair value information on Turquoise Water's assets and liabilities is also provided.

In addition to the assets reported on Turquoise Water's balance sheet, the following previously unreported intangible assets are identified:

In addition to the assets reported on Turquoise Water's balance sheet, the following previously unreported intangible assets are identified:

Required a. Prepare the journal entry DPSG makes to record this acquisition as a merger.

b. Now assume DPSG acquires all of the stock of Turquoise Water. Prepare the journal entry DPSG makes to record this acquisition as a stock acquisition.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q90: Use the following information to answer

Q91: Use the following information to answer

Q92: Arnprior pays $4,000 in cash to buy

Q93: At the beginning of 2020, Pentron

Q94: To induce the owners of Splunk

Q96: IBM acquired all of DemandTec's assets

Q97: Use the following information to answer

Q98: Use the following information to answer

Q99: Use the following information to answer

Q100: Plattsburgh Company acquired all of Sedona Corporation's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents