Delight Candy acquires all of the assets and liabilities of Orbit Brands. Delight incurs the following costs for the acquisition:

•5,000,000 shares of new Delight common stock, par value $0.10/share, market value $6/share, issued to the former shareholders of Orbit

•Registration fees connected with issuing the new shares, $200,000, paid in cash

•$1,000,000 in cash paid to retire the outstanding Orbit stock

•Consulting fees paid to Goldman Sachs, in cash: $1,100,000

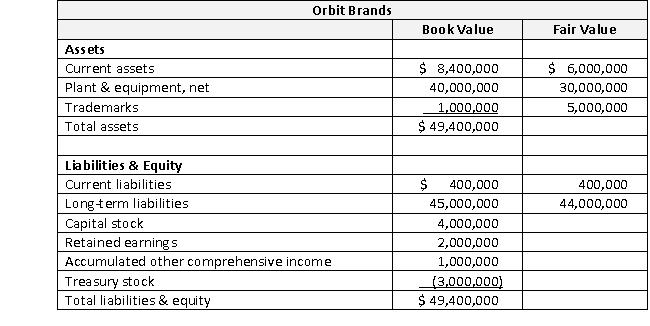

The balance sheet of Orbit immediately prior to the acquisition is as follows:

In addition to the assets and liabilities already reported, Orbit has the following previously unrecorded intangible assets that meet the requirements for capitalization:

In addition to the assets and liabilities already reported, Orbit has the following previously unrecorded intangible assets that meet the requirements for capitalization:

Required a. Prepare the journal entry or entries to record the acquisition on Delight's books.

b. Assume the same information as above, but Orbit has an additional previously unreported intangible that meets the requirements for capitalization: a noncompetition agreement with a fair value of $10,000,000. All fair value calculations have been double checked for accuracy and found to be correct. Make the journal entry or entries to record the acquisition on Delight's books.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q100: Plattsburgh Company acquired all of Sedona Corporation's

Q101: Patterson Corporation acquired Slees Company, with the

Q102: On November 30, 2019, Pronto Corporation acquired

Q103: On September 30, 2020, Pepper Corporation acquired

Q104: Plains Company pays $15,000,000 in cash

Q106: Schenk Corporation's balance sheet immediately prior to

Q107: Plunk Corporation currently holds a 75 percent

Q108: Paxata Corporation holds a 35 percent interest

Q109: Peabody Company acquires all of the assets

Q110: PNC Corporation acquires all of the assets

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents