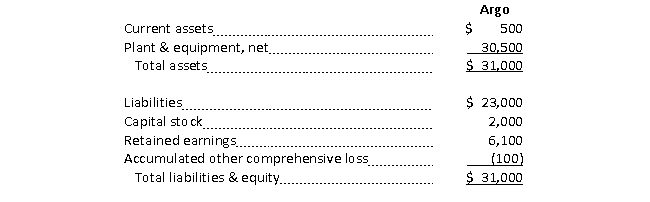

On January 1, 2015, Coca-Cola and another company jointly acquired Argo Natural Juices. Each acquiring company paid $10 million to acquire 50% of Argo. At the date of acquisition, Argo's book value was $6 million, consisting of $2 million in capital stock, $3.7 million in retained earnings, and 0.3 million in accumulated other comprehensive income. The basis difference was attributed entirely to goodwill. It is now December 31, 2020. Argo reported net income of $240,000, other comprehensive income of $10,000, and declared and paid cash dividends of $40,000 in 2020. Coca-Cola treats Argo as an equity method investment. Argo's balance sheet at December 31, 2020, is as follows (in thousands):

Required a. Prepare Coca-Cola's 2020 entries related to its investment in Argo.

Required a. Prepare Coca-Cola's 2020 entries related to its investment in Argo.

b. Calculate the ending balance in Investment in Argo, appearing on Coca-Cola's December 31, 2020 balance sheet.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q97: Grant Company acquired 40% of the voting

Q98: Solac Company acquires 30% of the

Q99: Konica Company acquires 40% of the

Q100: Delta Corporation has owned 45% of the

Q101: Franklin Corporation owns 15% of the voting

Q103: On January 1, 2020, Edgecor Corporation

Q104: Spritz Company owns 15% of the stock

Q105: Delicious Delicacies acquires the assets and

Q106: Kent Industries acquires the assets and

Q107: International Beverages acquires Ecoplastics Recycling Company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents