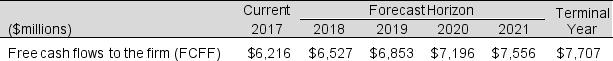

Assume the following free cash flows for Aiello Inc. for 2016 and forecasted FCFF for 2017 onward (in millions) : The DCF value of the firm using the FCFF information above, a discount rate of 6%, and an expected terminal growth rate of 2%, is:

The DCF value of the firm using the FCFF information above, a discount rate of 6%, and an expected terminal growth rate of 2%, is:

A) $176,900 million

B) $126,028 million

C) $145,189 million

D) $181,836 million

E) None of the above

Correct Answer:

Verified

Q25: Which of the following represents the present

Q26: Alpine Corporation reported the following information for

Q27: McMahon Company manufactures SIM cards for cell

Q28: A company can increase free cash flows

Q29: Which of the following descriptions of the

Q31: Which of the following descriptions of the

Q32: Heller Enterprises reports the following information. What

Q33: Barrington Corporation reports the following information. What

Q34: Which of the following descriptions of Residual

Q35: Which of the following is incorrect (rw

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents