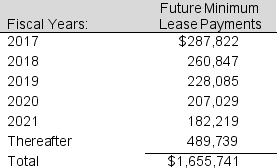

American Eagle Outfitters includes the following in its fiscal 2016 annual report (in thousands):

Required:

Required:

a. Calculate the present value of operating lease payments using a discount rate of 6% and rounding the remaining lease life to the nearest whole year.

b. Assume that the leased equipment has a useful life of 9 years, no salvage value, and straight-line depreciation is used. Estimate the effect on net operating profit before tax of capitalizing these leases. Assume that rental expense in 2016 is the same as 2017 lease payments.

c. How would ROE and the other financial ratios from the ROE decomposition be affected if the company capitalized these operating leases?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q49: The 2016 Form 10-K of Dow Chemical

Q50: The 2016 Form 10-K of Dow Chemical

Q51: As a result of using accelerated depreciation

Q52: Cranberry Chemical recorded a pretax restructuring charge

Q53: The income tax footnote to the financial

Q55: The following is an excerpt from the

Q56: Federated Investors, Inc. includes the following in

Q57: California Enterprises Inc. reports the following in

Q58: The following pension information was disclosed by

Q59: International Paper Company disclosed the following pension

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents