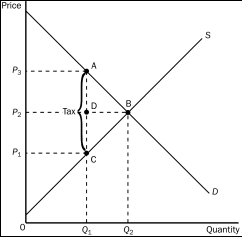

Figure 8-2

-Refer to Figure 8-2.The per unit burden of the tax on buyers is

A) P₃ - P₁.

B) P₃ - P₂.

C) P₂ - P₁.

D) Q₂ - Q₁.

Correct Answer:

Verified

Q43: The loss in total surplus resulting from

Q58: When a tax is levied on buyers,

A)the

Q59: Which of the following quantities decrease in

Q59: Deadweight loss is the

A)decline in total surplus

Q60: When the price of a good is

Q61: The supply curve and the demand curve

Q62: Figure 8-2 Q64: Taxes cause deadweight losses because Q65: Figure 8-2 Q66: The supply curve and the demand curve

![]()

A)taxes reduce the

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents