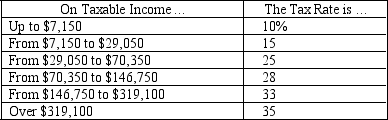

Table 12-1

-Refer to Table 12-1.If Chris has $100,000 in taxable income,his tax liability will be

A) $8,302.

B) $22,627.

C) $28,000.

D) $29,650.

Correct Answer:

Verified

Q44: A transfer payment is a government payment

A)to

Q49: Suppose that in 2009 the average citizen's

Q50: Table 12-1 Q55: For state and local governments,sales taxes and Q56: Which of the following contributes to the Q57: Most health care economists believe that it Q59: Suppose that in 2012 the average citizen's Q66: When government receipts exceed total government spending Q87: The tax that generates the most revenue Q126: From 1950 to today,government spending on Social

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents