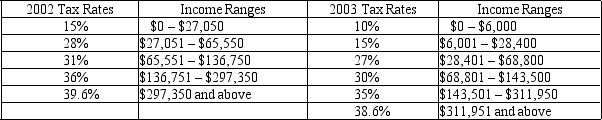

Table 12-2

United States Income Tax Rates for a Single Individual, 2002 and 2003.

-Refer to Table 12-2.Surbhi is a single person whose taxable income is $150,000 a year.What is her marginal tax rate in 2003?

A) 15%

B) 27%

C) 30%

D) 35%

Correct Answer:

Verified

Q114: Table 12-2

United States Income Tax Rates for

Q122: Kyle places a $10 value on a

Q123: Kyle places a $10 value on a

Q151: One tax system is less efficient than

Q158: An efficient tax system is one that

Q166: Taxes create deadweight losses because they

A) reduce

Q186: Deadweight losses represent the

A) inefficiency that taxes

Q208: Scenario 12-1

Suppose Jim and Joan receive great

Q307: When taxes are imposed on a commodity,

A)there

Q315: An optimal tax is one that minimizes

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents