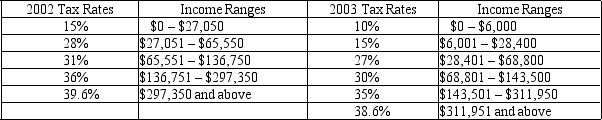

Table 12-2

United States Income Tax Rates for a Single Individual, 2002 and 2003.

-Refer to Table 12-2.Surbhi is a single person whose taxable income is $150,000 a year.What happened to her marginal tax rate between 2002 and 2003?

A) It increased.

B) It decreased.

C) It did not change.

D) We do not have enough information to answer this question.

Correct Answer:

Verified

Q99: Table 12-2

United States Income Tax Rates for

Q100: Table 12-2

United States Income Tax Rates for

Q148: One reason that deadweight losses are so

Q161: Deadweight losses are associated with

A) taxes that

Q281: A tax system with little deadweight loss

Q282: In designing a tax system, policymakers have

Q290: Which of the following is a characteristic

Q291: The deadweight loss of a tax is

A)the

Q303: Deadweight losses occur in markets in which

A)firms

Q316: Taxes can create deadweight losses because they

A)allow

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents