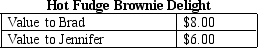

Table 12-4

-Refer to Table 12-4.Suppose that the government imposes a $2 tax on delights,causing the price to increase from $5.00 to $7.00.Deadweight loss arises because

A) Jennifer will pay more tax as a percentage of her value of delights than Brad.

B) Brad must pay the $2.00 tax from his consumer surplus.

C) Brad will have to pay a higher price for delights.

D) Jennifer will leave the market.

Correct Answer:

Verified

Q161: The deadweight loss associated with a tax

Q210: Table 12-3 Q212: Scenario 12-1 Q213: Scenario 12-1 Q215: Table 12-4 Q216: Scenario 12-1 Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents

![]()

Suppose Jim and Joan receive great

Suppose Jim and Joan receive great

![]()

Suppose Jim and Joan receive great