Consider two projects, Project P and Project Q, with the following end of year cash flows: Which of the following statements is correct?

Which of the following statements is correct?

A) The crossover discount rate is less than the internal rate of return of both projects.

B) If the cost of capital is 5 percent, the profitability index of both projects will be less than 1.0.

C) If these two projects are independent and the cost of capital is 6 percent, we should reject both projects.

D) If these two projects are mutually exclusive and the cost of capital is 5 percent, we should accept only Project P.

Correct Answer:

Verified

Q43: Consider the following project information:

Initial outlay =

Q44: We should accept a project if:

A) profitability

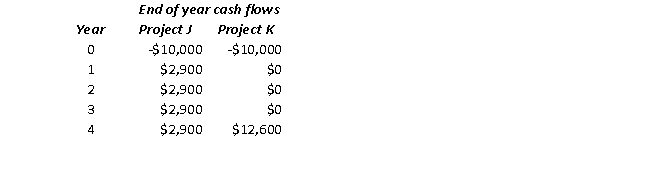

Q45: Consider two projects, Project J and Project

Q46: Consider two projects, Project J and Project

Q47: Consider two projects, Project J and Project

Q49: Allotting investment capital among available investment projects

Q50: When selecting among projects when there is

Q51: Consider these five projects: Q52: Consider these five projects: Q53: Consider these five projects: Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

![]()

![]()