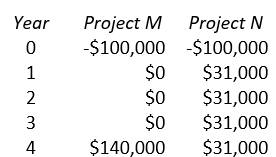

Consider two projects, Project M and Project N, with the following cash flows:

The appropriate project cost of capital for both projects is 9 percent. The value-maximizing decision regarding these projects is:

A) accept Project M and reject Project N if these projects are mutually exclusive.

B) accept Project N and reject Project M if these projects are mutually exclusive.

C) accept Project M and Project N if these projects are independent projects.

Correct Answer:

Verified

Q86: What is the modified internal rate of

Q87: What is the modified internal rate of

Q88: Economic profit is accounting profit, plus non-cash

Q89: The opportunity to defer the investment in

Q90: Consider a project with the following end

Q92: The cross-over discount rate for the investment

Q93: The internal rate of return is best

Q94: The internal rate of return approach to

Q95: The reinvestment rate assumed in the net

Q96: Consider the following cash flows for Project

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents