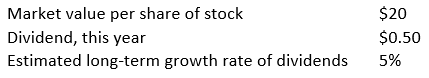

Consider the following information on a company: The implied required rate of return on these shares is closest to:

The implied required rate of return on these shares is closest to:

A) 2.5%.

B) 5.0%.

C) 7.5%.

D) 7.625%

Correct Answer:

Verified

Q20: The value of a $30 par value

Q21: The value of a $30 par value

Q22: The value of a $30 par value

Q23: Use the constant growth dividend discount model

Q24: The market value of a company's shares

Q26: The market value of a company's shares

Q27: PVGO = P0 - (EPS1 / re)

Q28: Using the constant growth dividend model with

Q29: Which of the following will not lead

Q30: If a company currently pay $1.00 per

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents