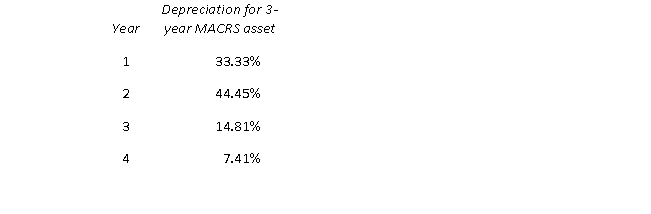

Suppose the Dallas Donut Company buys a donut fryer that costs $50,000. If the donut fryer is classified as a 3-year MACRS asset, the second year's depreciation for tax purposes on this fryer, given the MACRS rates: is closest to:

is closest to:

A) $11,110.

B) $16,665.

C) $22,225.

D) $38,890.

Correct Answer:

Verified

Q44: The end of year balance of cash

Q45: Which method of depreciation is required for

Q46: The U.S. tax system is a progressive

Q47: Suppose the dividends received deduction is 70

Q48: Suppose the dividends received deduction is 80

Q50: Suppose the Dallas Donut Company buys a

Q51: Suppose the Apple Company buys a boiler

Q52: Suppose the Apple Company buys a boiler

Q53: Suppose the Apple Company buys a boiler

Q54: Suppose the Cement Company has a mixer

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents