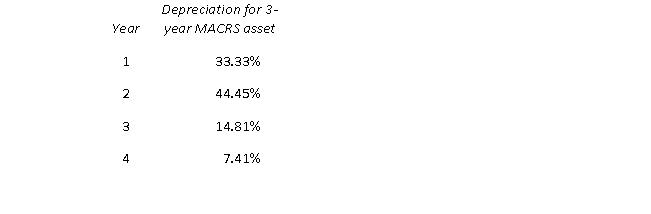

Suppose the Apple Company buys a boiler that costs $100,000. If the boiler is classified as a 3-year MACRS asset, the second year's depreciation for tax purposes on this fryer, given the MACRS rates: is closest to:

is closest to:

A) $7,410.

B) $33,330.

C) $44,450.

D) $77,780.

Correct Answer:

Verified

Q46: The U.S. tax system is a progressive

Q47: Suppose the dividends received deduction is 70

Q48: Suppose the dividends received deduction is 80

Q49: Suppose the Dallas Donut Company buys a

Q50: Suppose the Dallas Donut Company buys a

Q52: Suppose the Apple Company buys a boiler

Q53: Suppose the Apple Company buys a boiler

Q54: Suppose the Cement Company has a mixer

Q55: Suppose the Machine Company has production equipment

Q56: Suppose the Prune Company has equipment that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents