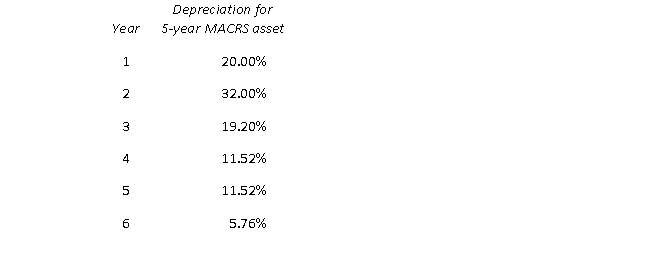

Suppose the Tucson Tuxedo Company has equipment that originally cost $1.2 million, and is classified as a 5-year MACRS asset, with the MACRS rates:

If the Tucson Tuxedo Company sells the equipment at the end of five years for $0.2 million, the capital gain and recapture of depreciation, respectively, are closest to:

A) $0; $1,130,880.

B) $0; $1,200,000.

C) $69,120; $1,130,880.

D) $69,120; $1,200,000.

Correct Answer:

Verified

Q52: Suppose the Apple Company buys a boiler

Q53: Suppose the Apple Company buys a boiler

Q54: Suppose the Cement Company has a mixer

Q55: Suppose the Machine Company has production equipment

Q56: Suppose the Prune Company has equipment that

Q58: Auditors, such as Deloitte & Touche L.L.P.,

Q59: Generally accepted accounting principles (GAAP) vary from

Q60: The establishment of Financial Accounting Standards Board

Q61: The auditor will issue a disclaimer of

Q62: The objective of the financial statements is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents