Optimum Properties (OP) is a privately held real estate investment company that purchases properties, constructs buildings such as shopping centers, movie theaters, and churches, and leases those facilities to retailers, entertainment companies, and church congregations. Often new properties become available at times when OP has insufficient cash on hand and to take advantage of the opportunity OP must borrow money. The chief financial officer (CFO) works closely with the chief executive officer (CEO) to determine whether a potential property investment warrants debt financing. If the CEO determines the property has sufficient potential, the CFO determines the dollar amount of cash needed, obtains preliminary information as to likely financing terms such as interest rate and maturity date, and enters a cash requisition in the enterprise system. The CFO then executes a financing agreement with a lender, thereby committing OP to receive cash and to later repay the cash plus specified interest. OP establishes a separate cash account for each property to aid in tracking cash inflows and outflows associated with each property. However, OP assesses the need for cash on an overall basis, rather than by account, there is no need to track a specific cash account with respect to a cash requisition or a loan agreement.

When loan proceeds are received, OP deposits them into the account established for the related property, where they remain until used for the property purchase. If the purchase falls through, which occasionally happens, the loan principal is repaid immediately from the cash account established for that property; any accrued interest is paid from OP's headquarters cash account. If the purchase proceeds as scheduled, a check for the purchase price is issued from the property cash account to the property owner. As rental revenue is generated from the property, resulting in cash deposits to the property cash account, the loan's principal and interest are gradually repaid.

OP tracks its cash disbursements by voucher number, and its cash receipts by remittance advice number. Less than 30% of the payments OP issues are for loan payments; other checks are written to vendors and employees. Payables clerks process cash disbursements to lenders and vendors; whereas payroll clerks process payments to employees. Cashiers process all types of cash receipts.

Required:

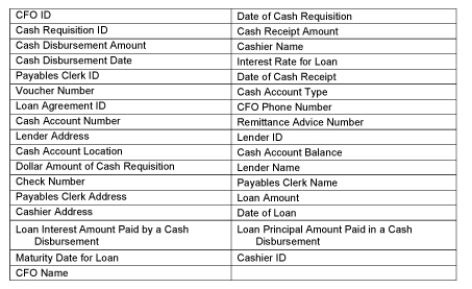

a. Prepare an REA business process level model for OP in ER diagram or grammar format including all relevant entities, relationships, attributes, and participation cardinalities. The following attributes are of interest to OP and should be included in your solution. Do not add or subtract any attributes.

b. Convert your REA business process level model into a set of minimal relational table structures.

b. Convert your REA business process level model into a set of minimal relational table structures.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q45: At the value system level, the financing

Q46: What document is often prepared after a

Q47: List at least four attributes of debt

Q48: List at least four attributes of equity

Q49: On the date on which an enterprise

Q50: Given the following relational database tables, calculate

Q51: Describe two different types of commitment events

Q52: Create a "generic" REA business process level

Q53: Create a "generic" REA business process level

Q55: Examine the following financing cycle table structures

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents