The Coolest Consultants (TCC) is an enterprise that provides consulting services to various clients. TCC's services include a wide variety ranging from marketing-oriented consulting to tax-planning services to computer system recommendations and installation. TCC's employees need different sets of skills to perform the various services. For example, tax-planning services must be performed by employees who have masters degrees in tax. At the beginning of each month, one of TCC's supervisors determines the staffing needs for the following month based on upcoming consulting service engagements. The supervisor records on the staffing plan the number of hours required for each type of labor (e.g. preparing a tax plan, installing a computer system, creating a marketing jingle, or developing a trademark) for the upcoming consulting service engagements. The supervisor also notes on the staffing plan whether the client has requested any specific employees for the service engagements. The supervisor then creates a schedule for the upcoming consulting service engagements by calling the employees who have the skills needed for each type of labor and verifying their availability and willingness to participate in the consulting engagements for a specified wage rate. The schedule lists each employee and the date and hours the employee will need to work on this engagement. When the consulting engagement occurs, details of the hours worked by each employee are recorded on separate timecards. The supervisor verifies the accuracy of each timecard and sends the approved timecards to the payroll department. On last day of each month, a payroll clerk summarizes each employee's timecards for consulting engagements in the month. The clerk calculates gross pay, withholdings, and net pay dollar amounts and enters the monthly payment information into the database. The net pay amounts are transferred to the employees' bank accounts via direct deposit and a pay stub is given to each employee for recordkeeping purposes.

Cash disbursements are tracked via voucher number, since check numbers and direct deposit numbers for different checking accounts may overlap. Less than half of the payments TCC issues are for payroll; other checks are written to vendors, stockholders, lenders, and so on. Payroll clerks process only payroll payments; employees in various other positions process nonpayroll payments.

To aid in scheduling, TCC must be able to look up the labor types for which an employee is qualified. Therefore after information about employees is entered into the system, information connecting them to the labor types they are capable of performing must also be entered.

Required:

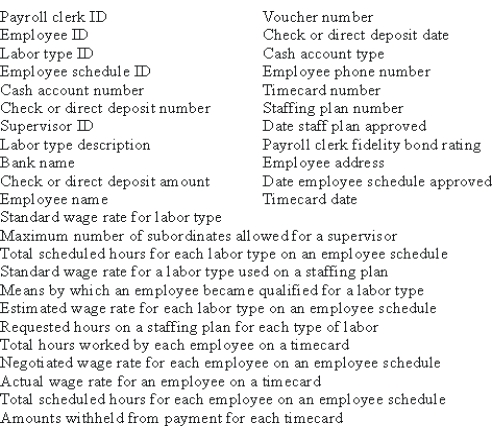

a. Prepare an REA business process level model for TCC in ER diagram or grammar format including all relevant entities, relationships, attributes, and participation cardinalities. The following attributes are of interest to TCC and should be included in your solution. Do not add or subtract any attributes.

b. Convert your REA business process level model into a set of minimal relational table structures.

b. Convert your REA business process level model into a set of minimal relational table structures.

Correct Answer:

Verified

TCC REA model in diagram f...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q44: How many employees acting as external business

Q45: What document is often used to capture

Q46: What is the difference between a time

Q47: Given the following tables, has a paycheck

Q48: Given the following tables, calculate the dollar

Q49: Given the following tables, determine which labor

Q50: Given the following tables, determine which employee(s)

Q51: Create a "generic" REA business process level

Q53: Consider the statement "the human resources or

Q54: Quickest Franks (QF) is a fast food

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents