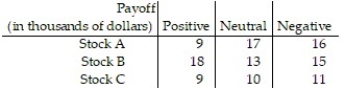

A person has hired an investment broker to buy stock. The broker has three different stock funds that are of interest, but each is sensitive to a certain economic indicator that is impossible to predict. The indicator will be positive, neutral, or negative. The table below shows the payoffs in thousands of dollars. Find the strategy that the broker should recommend to maximize the expected value of the investment.

A) Invest in Stock A with probability 1, invest in Stock B with probability 0, and invest in Stock C with probability 0.

B) Invest in Stock A with probability 5/13, invest in Stock B with probability 8/13, and invest in Stock C with probability 0.

C) Invest in Stock A with probability 4/13, invest in Stock B with probability 9/13, and invest in Stock C with probability 0.

D) Invest in Stock A with probability 0, invest in Stock B with probability 1, and invest in Stock C with probability 0.

Correct Answer:

Verified

Q42: If M is a matrix game, then

Q43: A small town has two competing grocery

Q44: Use the simplex method to find the

Q45: Use the simplex method to find the

Q46: Use the simplex method to find the

Q47: Use the simplex method to find the

Q48: A company has three different marketing strategies

Q49: A company has three different marketing strategies

Q50: A company has three products that fluctuate

Q52: A person is considering three different stocks,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents