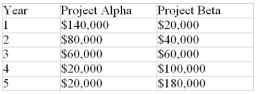

A company is evaluating two mutually exclusive projects. Both require an initial investment of $240,000 and have no appreciable disposal value. Their expected profits over their five-year lifetimes are as follows:

The company's cost of capital is 12%. Calculate the NPV and IRR for each project. Which project should be chosen? Why?

The company's cost of capital is 12%. Calculate the NPV and IRR for each project. Which project should be chosen? Why?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q51: Two mutually exclusive investments are available to

Q52: Academic Publishing is trying to decide which

Q53: Due to a restricted capital budget, a

Q54: Two mutually exclusive projects each require an

Q55: A company is examining two mutually exclusive

Q57: The expected profits from a $52,000 investment

Q58: A firm is considering the purchase of

Q59: Projects X and Y both require an

Q60: A capital investment requiring a single initial

Q61: Investment proposals A and B require initial

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents