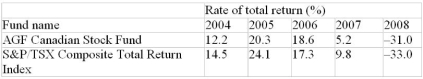

The following table presents the rates of total return in successive years from 2004 to 2008 for the AGF Canadian Stock Fund and for the benchmark Toronto Stock Exchange S&P/TSX Composite Index. By how much did the mutual fund's overall percentage return exceed or fall short of the Index's growth?

Correct Answer:

Verified

Q48: Calculate the income yield, capital gain yield,

Q49: Calculate the income yield, capital gain yield,

Q50: Calculate the income yield, capital gain yield,

Q51: Assume that the TD Bank shares in

Q52: Loblaw shares in Table 9.3 will pay

Q54: The following table presents the rates of

Q55: The following table presents the rates of

Q56: The following table presents the rates of

Q57: The home the Bensons purchased 13 years

Q58: One thousand shares of Frontier Mining were

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents