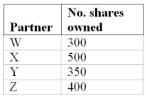

Geological Consultants Ltd. is a private company with four shareholders: W, X, Y, and Z. Their respective shareholdings are shown in the table below. X is retiring and has come to an agreement with the other three shareholders to sell his shares to them for $175,000. The agreement calls for the 500 shares to be purchased and allocated among W, Y, and Z in the same ratio as their present shareholdings. The shares are indivisible, and consequently the share allocation must be rounded to integer values.

a. What implied value does the transaction place on the entire company?

b. How many shares will W, Y, and Z each own after the buyout?

c. What amount will each of the continuing shareholders contribute toward the $175,000 purchase price? Prorate the $175,000 on the basis of the allocation of the shares in part (b).

Correct Answer:

Verified

b) W = 4...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q30: Last year, the U.S. sales of Ford,

Q31: The Ministry of Education reported that the

Q32: Kevin, Lyle, and Marnie operate Food Country

Q33: The following table shows National Paper Products'

Q34: Canada reported the following sales of alcoholic

Q36: Use the currency exchange rates in Table

Q37: Use the currency exchange rates in Table

Q38: Use the currency exchange rates in Table

Q39: Use the currency exchange rates in Table

Q40: Use the currency exchange rates in Table

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents