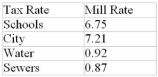

A homeowner's tax statement lists the following mill rates for various municipal services:  The homeowner paid $3937.50 in property taxes last year. What is the assessed value of his property?

The homeowner paid $3937.50 in property taxes last year. What is the assessed value of his property?

A) $264,617

B) $265,509

C) $461,066

D) $250,000

E) $437,500

Correct Answer:

Verified

Q179: Calculate the PST on a sweater costing

Q180: Calculate the PST on a jacket costing

Q181: M Studios (Calgary) had retail sales of

Q182: M Studios (Ontario) had retail sales of

Q183: A homeowner's tax statement lists the following

Q185: Evaluate: Q186: Evaluate (8 - 5 ÷ 2) ÷ Q187: Evaluate 0.5 × 0.001 = Q188: Evaluate Q189: Evaluate (8 ÷ 5 - 2) ÷![]()

A) 0.0005

B) 0.005

C)![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents