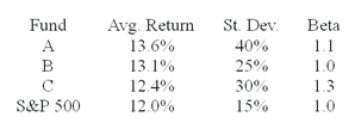

The average returns, standard deviations and betas for three funds are given below along with data for the S&P 500 index. The risk-free return during the sample period is 6%.  You wish to evaluate the three mutual funds using the Jensen measure for performance evaluation. The fund with the highest Jensen measure of performance is ________.

You wish to evaluate the three mutual funds using the Jensen measure for performance evaluation. The fund with the highest Jensen measure of performance is ________.

A) Fund A

B) Fund B

C) Fund C

D) S&P500

Correct Answer:

Verified

Q1: The risk-free rate, average returns, standard deviations

Q2: The risk-free rate, average returns, standard deviations

Q3: The average returns, standard deviations and betas

Q4: The average returns, standard deviations and betas

Q6: The table presents the actual return of

Q7: The table presents the actual return of

Q8: What is the contribution of security selection

Q9: What is the contribution of asset allocation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents