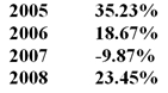

You have the following rates of return for a risky portfolio for several recent years: The annualised average return on this investment is ________.

A) 16.15%

B) 16.87%

C) 21.32%

D) 15.60%

Correct Answer:

Verified

Q1: The geometric average of -12%, 20% and

Q2: You have an APR of 7.5% with

Q3: Two assets have the following expected returns

Q4: The formula is used to calculate the

Q5: Security A has a higher standard deviation

Q6: You are considering investing $1000 in a

Q7: You have the following rates of return

Q9: If the bid price is $15.12 and

Q10: Consider the following limit order book of

Q11: Based on the outcomes in the table

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents