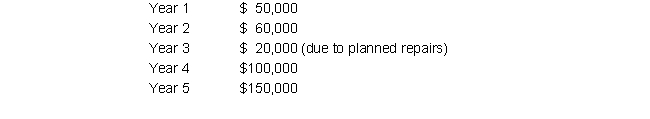

Hilltop Moving Company is considering investing in two new trucks for their residential moving business. The investment will require an outlay of $190,000 initially, and is expected to generate the following pre-tax cash flows:

The trucks would be fully depreciated on a straight-line basis over the course of 5 years, with a full year of depreciation taken in the first year. Even though they will be fully depreciated, the company expects to be able to sell the trucks for $20,000. The company expects the trucks to have a combined salvage value of $20,000. The company uses a discount rate of 9%, and pays a marginal tax rate of 25%.

The trucks would be fully depreciated on a straight-line basis over the course of 5 years, with a full year of depreciation taken in the first year. Even though they will be fully depreciated, the company expects to be able to sell the trucks for $20,000. The company expects the trucks to have a combined salvage value of $20,000. The company uses a discount rate of 9%, and pays a marginal tax rate of 25%.

What is the cash payback period of this proposed investment? (Round to 2 decimal places)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: Acme Co. has excess cash that it

Q4: Shumer Inc. is a construction company that

Q5: Shumer Inc. is a construction company that

Q6: Scription Inc. has additional cash available for

Q7: Wylie Contracting Inc. (WCI) is a contracting

Q9: Hilltop Moving Company is considering investing in

Q10: InterCont is a construction company that plans

Q11: InterCont is a construction company that plans

Q12: Starsky is a research company that plans

Q13: Starsky is a research company that plans

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents