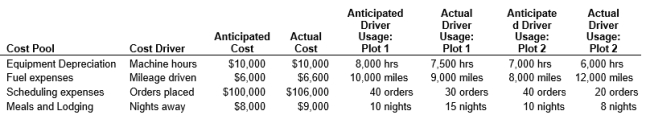

Renewable Timber Inc. is a lumber company. The company owns two 20,000-acre plots of timber, and sells to construction suppliers. Renewable Timber uses ABC costing to better manage the company, and has accumulated the following information for last year:

At the end of the year, Renewable Timber's management is concerned about their financial statements. Overhead costs were greater than expected, but sales did not meet budgeted levels. Each yard of timber generally sells for $4.

At the end of the year, Renewable Timber's management is concerned about their financial statements. Overhead costs were greater than expected, but sales did not meet budgeted levels. Each yard of timber generally sells for $4.

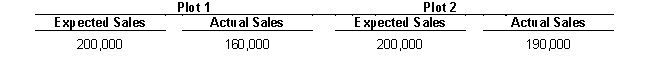

Below is information relating to production this year, in board-feet:

Assume that you are Renewable Timber's auditor, and you are worried that management is trying to absorb overhead costs into inventory.

Assume that you are Renewable Timber's auditor, and you are worried that management is trying to absorb overhead costs into inventory.

Assuming that Renewable Timber has the storage capacity to accommodate overproduction, by how much would you expect Operating Income to increase if management were to have a non-sales-driven production run of 10,000 board-feet, requiring 350 machine hours, 500 miles driven, and 2 overnight stays?

The production run would naturally not have an order associated, but you assume that it would incur the same scheduling costs as 1 order. (Note: round all driver rates to the nearest cent).

Correct Answer:

Verified

Depreciation: $1...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: SCS Co. uses activity . The company

Q2: SCS Co. uses activity-based costing in their

Q3: Advanced Coding is a software development company

Q4: Advanced Coding is a software development company

Q5: What is a cost driver?

Q7: Old Lace (OL) is a well-established manufacturing

Q8: Use the following information to answer

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents