Huntley Company paid $52,800 for a four-year insurance policy on September 1 and recorded the $52,800 as a debit to Prepaid Insurance and a credit to Cash.

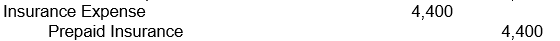

What adjusting entry should Huntley make on December 31, the end of the accounting period (no previous adjustment has been made) ?

A)

B)

C)

D)

Correct Answer:

Verified

Q16: Early in the accounting period, Ed Sheer,

Q17: On September 1, Tree Company began a

Q18: On September 1, Knowledgeable Company began a

Q19: On December 31, the end of the

Q20: On December 31, the end of the

Q22: Hot Rod Company paid $158,400 for a

Q23: Williams Company paid $48,000 for a two-year

Q24: Nair Company paid $144,000 for a two-year

Q25: The Green Grape Company's Office Supplies account

Q26: The Yellow Apple Company's Office Supplies account

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents