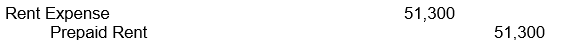

Dennison Company signed a one-year lease on April 1, 2019, and paid the $68,400 total year's rent in advance. Dennison recorded the transaction as a debit to Prepaid Rent and a credit to Cash.

What adjusting entry should Dennison make on December 31, 2019 (no previous adjustment has been made) ?

A)

B)

C)

D)

Correct Answer:

Verified

Q29: During their first year, Adrian & Associates

Q30: During their first year, Ann Zi &

Q31: The Boston Company's Supplies account balance at

Q32: The Tracey Real Estate Company's Supplies account

Q33: Champaign Company signed a one-year lease on

Q35: Happy Company signed a two-year lease on

Q36: Subariffic Company signed a two-year lease on

Q37: Art Company calculates that interest of $1,800

Q38: Owl Company calculates that interest of $5,400

Q39: Assume December 31 is a Wednesday. Rite

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents