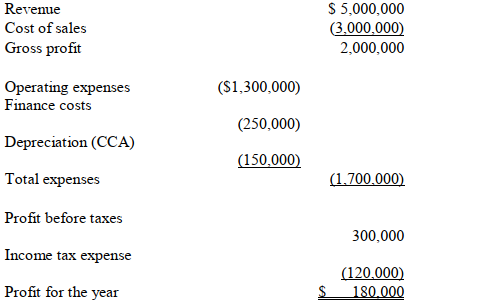

Several entrepreneurs are contemplating investing in a retail business. The cost of the initial investment in non-current assets is estimated at $2 million. Included in the business plan was the following projected statement of income:  During the first year of operations, inventories and trade receivables are estimated to be $500,000 and $300,000 respectively and trade and other payables are estimated at $200,000. During the second year of operations, inventories are expected to increase by additional $100,000, and trade receivables by an additional $50,000. Trades and other payables are expected to reach $250,000. Although the company's cost of capital is expected to be 12%, management would like to secure a 20% return. The project's life span is expected to be 20 years at which time they hope to sell their non-current assets including goodwill for $13 million and secure 50% of their working capital.

During the first year of operations, inventories and trade receivables are estimated to be $500,000 and $300,000 respectively and trade and other payables are estimated at $200,000. During the second year of operations, inventories are expected to increase by additional $100,000, and trade receivables by an additional $50,000. Trades and other payables are expected to reach $250,000. Although the company's cost of capital is expected to be 12%, management would like to secure a 20% return. The project's life span is expected to be 20 years at which time they hope to sell their non-current assets including goodwill for $13 million and secure 50% of their working capital.

-The net present value using the hurdle rate is ________________________.

Correct Answer:

Verified

Q201: The management of ABC Inc. is considering

Q202: The management of ABC Inc. is considering

Q203: Several entrepreneurs are contemplating investing in a

Q204: Several entrepreneurs are contemplating investing in a

Q205: Several entrepreneurs are contemplating investing in a

Q206: Several entrepreneurs are contemplating investing in a

Q207: Several entrepreneurs are contemplating investing in a

Q208: Several entrepreneurs are contemplating investing in a

Q209: Several entrepreneurs are contemplating investing in a

Q211: Several entrepreneurs are contemplating investing in a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents