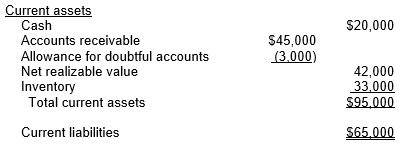

The following is a partial balance sheet for Que Company dated December 31, 2010:

During 2010, $4,000 of accounts receivable were written off and bad debts expense recognized on Que's 2010 net income statement was $8,000.However, the president of the company believes that $2,500 of these receivables were written off too soon.She correctly believes that there is a good chance that they will be collected next year.

During 2010, $4,000 of accounts receivable were written off and bad debts expense recognized on Que's 2010 net income statement was $8,000.However, the president of the company believes that $2,500 of these receivables were written off too soon.She correctly believes that there is a good chance that they will be collected next year.

The reason for her position is that Que has a debt covenant requiring it to maintain a current ratio of 1.5.The president believes that by reversing the write-off of $2,500 of accounts receivable, the current assets will be $97,500 and the current ratio will be 1.5.However, the chief financial officer states that a better approach is to pay off some accounts payable.If the company paid $5,000 of accounts payable, the current ratio would become the minimum 1.5 required by the debt covenant.

Comment, with numerical illustration, on the president's and chief financial officer's positions.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q48: The following are the revenue and expense

Q49: At the beginning of 2010, Kacie Corp.'s

Q50: Before adjusting entries, Kelvin's accounts receivable and

Q51: Yakir Company began business on August 1,

Q52: Nakita Inc.reported beginning inventory of $90,000, ending

Q53: Bradley Incorporated owns a chain of retail

Q54: Patrick Incorporated owns a chain of retail

Q55: Preston Bank has $50 million of loans

Q57: A major airline issues frequent flyer credits

Q58: What three characteristics should all liabilities that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents