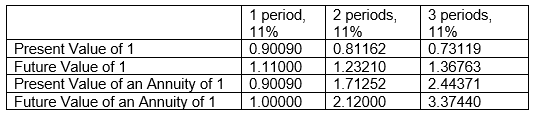

Gaynor Company is considering purchasing equipment.The equipment will produce the following cash flows: Year 1, $25,000; Year 2, $45,000; Year 3, $60,000.Below is some of the time value of money information that Gaynor has compiled that might help them in their planning and compounded interest decisions.  Gaynor requires a minimum rate of return of 11%.To the closest dollar, what is the maximum price Gaynor should pay for the equipment?

Gaynor requires a minimum rate of return of 11%.To the closest dollar, what is the maximum price Gaynor should pay for the equipment?

A) $317,682

B) $102,917

C) $165,253

D) $246,209

Correct Answer:

Verified

Q7: Carter Holding Co.intends to purchase a new

Q8: Karla Simpson Carson invested $12,000 at 8%

Q9: Rowan and Lisa Sharp invested $10,000 in

Q10: Morgan Company earns 11% on an investment

Q11: Everett Corporation issues a 8%, 9-year mortgage

Q13: Mitch has been offered three different contracts

Q14: Mitch has been offered three different contracts

Q15: Kaitlin is contemplating investing in Cocoa Beach

Q16: For each of the following situations in

Q17: For each of the following situations in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents