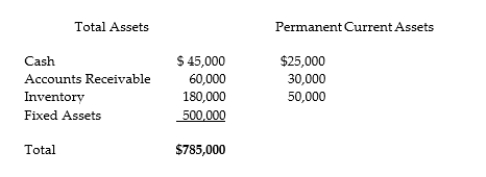

Use the following information to answer the question below.

How much would your firm have in current liabilities and how much would it have in long term debt & equity if a moderate approach for financing working capital were employed?

How much would your firm have in current liabilities and how much would it have in long term debt & equity if a moderate approach for financing working capital were employed?

Correct Answer:

Verified

Q86: Respond to this statement: It is impossible

Q87: Explain the liquidity/profitability trade off faced by

Q88: Your firm has permanent current assets of

Q89: If interest rates are stable, should a

Q90: Use the following information to answer the

Q92: Why is a company's working capital position

Q93: Explain the difference between permanent current assets

Q94: Why is an aggressive working capital financing

Q95: Two separate firms have the following financial

Q96: Distinguish between temporary and permanent current assets.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents