Use the following information to answer the question below.

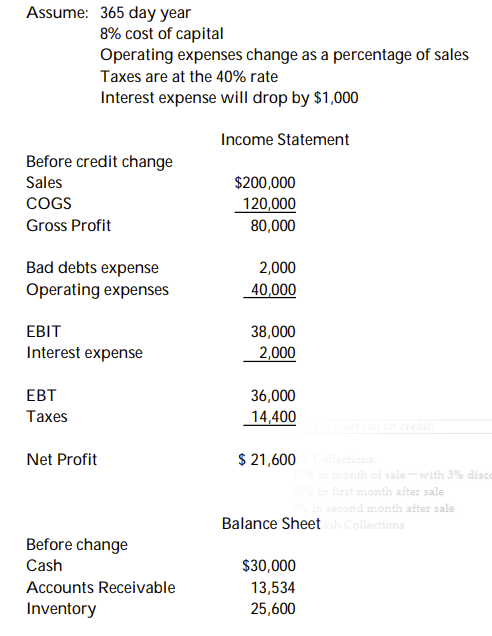

A firm currently offers credit terms of 2/10, n/30. You want to change the credit policy to 2/10, n/35. As a result of this change, sales are expected to rise by 15%; bad debts will rise from 1% to 3% of sales. All sales are credit sales.

Currently 30% of customers pay off their accounts in 10 days with 69% paying in 30 days and 1% paying in 100 days. The change will not affect the 30% paying early and taking the discount,but, is expected to increase the 1% late payers to 3%. (ie. with the new policy they only expect 67% will pay on the 35 days and 3% will pay in 100 days)

-What is the amount of the new accounts receivable after the credit change?

A) $15,564

B) $18,557

C) $18,954

D) $16,000

Correct Answer:

Verified

Q155: With respect to deciding upon the optimal

Q156: A firm's credit policy is best described

Q157: Tightening the credit policy will most likely:

A)

Q158: Use the following information to answer the

Q159: Use the following information to answer the

Q161: Use the following information to answer the

Q162: Calculate the NPV of a change in

Q163: If a firm's level of accounts receivable

Q164: The guidelines which a credit manager follows

Q165: Which of the following best describes why

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents