Use the following information to answer the question below.

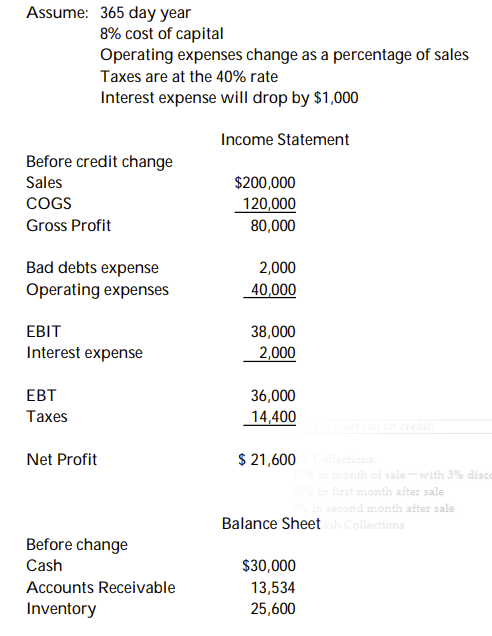

A firm currently offers credit terms of 2/10, n/30. You want to change the credit policy to 2/10, n/35. As a result of this change, sales are expected to rise by 15%; bad debts will rise from 1% to 3% of sales. All sales are credit sales.

Currently 30% of customers pay off their accounts in 10 days with 69% paying in 30 days and 1% paying in 100 days. The change will not affect the 30% paying early and taking the discount,but, is expected to increase the 1% late payers to 3%. (ie. with the new policy they only expect 67% will pay on the 35 days and 3% will pay in 100 days)

-What will cash be after the increase in sales if cash remains the same percent of sales?

A) $30,000

B) $34,000

C) $33,700

D) $34,500

Correct Answer:

Verified

Q156: A firm's credit policy is best described

Q157: Tightening the credit policy will most likely:

A)

Q158: Use the following information to answer the

Q159: Use the following information to answer the

Q160: Use the following information to answer the

Q162: Calculate the NPV of a change in

Q163: If a firm's level of accounts receivable

Q164: The guidelines which a credit manager follows

Q165: Which of the following best describes why

Q166: If you were very concerned about a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents