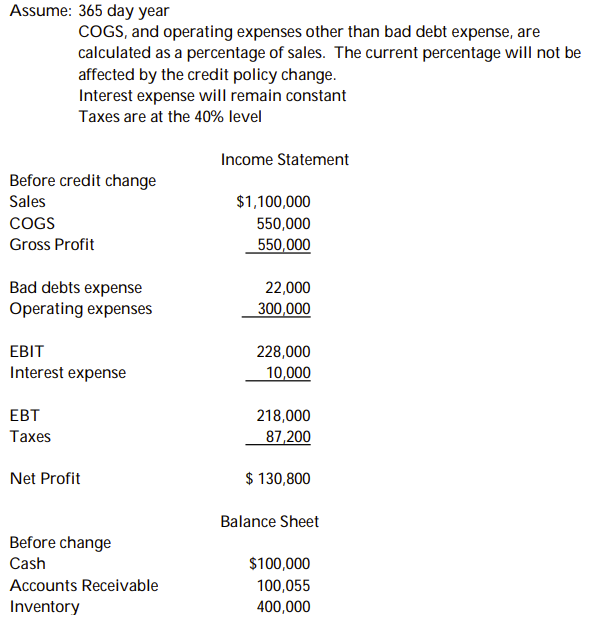

A firm currently offers credit terms of 2/15, n/45. You want to change the credit policy to 2/10, n/40. As a result of this change, sales are expected to rise by 12%, bad debts will rise from 2% to 4%. All sales are credit sales.

Currently 43% of customers pay off their accounts in 15 days with 55% paying in 45 days and 2% paying in 100 days or not at all. The change will decrease those paying early to 42% and will decrease those paying net to 54% with 4% late payers.

a. Calculate the new ACP

a. Calculate the new ACP

b. Calculate the new net income

c. Calculate the new accounts receivable.

Correct Answer:

Verified

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q189: Costs incurred whenever more inventory is needed

Q190: The inventory system developed to overcome limited

Q191: If sales are projected to be 10,000

Q192: AM&M had annual credit sales of $20,000,000

Q193: A firm's current credit policy is 2/10,

Q195: If cash collections from sales increase by

Q196: If annual sales volume in units =

Q197: Why might a firm choose to factor

Q198: What is the difference between the ABC

Q199: How can a firm determine its optimal

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents