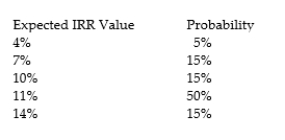

You have estimated the IRR for a new project with the following probabilities:

a. Calculate the mean of the project.

a. Calculate the mean of the project.

b. Calculate the standard deviation of the project.

c. Calculate the coefficient of variation.

d. Calculate the expected IRR of the new portfolio with the new project. The current portfolio has an expected IRR of 9% and a standard deviation of 3% and will represent 60% of the total portfolio.

Correct Answer:

Verified

b. Standard d...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q35: In cases of ranking conflict among mutually

Q36: Explain what is meant by firm risk

Q37: Calculate the NPV and the IRR for

Q38: If there are multiple IRRs, how will

Q39: A firm is considering a project with

Q41: Explain the difference between the accept/reject decision

Q42: Why does capital rationing occur if theory

Q43: What are some of the problems associated

Q44: Why may the IRR and NPV methods

Q45: What is capital rationing? If imposed, what

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents