Multiple Choice

The discounted cash flow model for bonds is best described as:

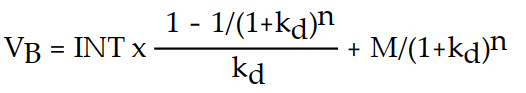

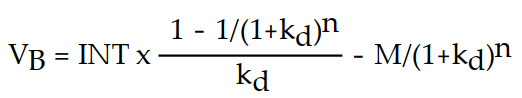

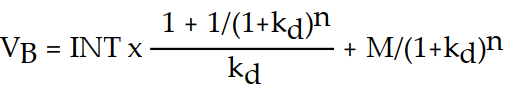

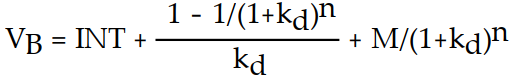

A)

B)

C)

D)

Correct Answer:

Verified

Related Questions

Q98: If the yield- to- maturity of a

Q99: If the yield- to- maturity of a

Q100: A bond is selling for 95% of

Q101: Calculate the price of a six- year

Q102: The discounted cash flow model for bonds:

A)

Q104: A bond sold at par with a

Q105: A bond with a fixed coupon has

Q106: A zero- coupon bond will have a

Q107: A bond is selling for 105% of

Q108: Calculate the price of a seven- year

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents