Use the following information to answer the question below.

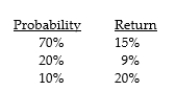

You hold a diversified portfolio of stocks and are considering investing in the XYZ Company. The firm's prospects look good and you estimate the following probability distribution of possible returns:

The return on the market is 13.5% and the risk free rate is 7%. You have calculated XYZ's beta from past returns as 1.3 and you believe this will be the future beta.

The return on the market is 13.5% and the risk free rate is 7%. You have calculated XYZ's beta from past returns as 1.3 and you believe this will be the future beta.

-Based on your calculations in the three questions above, should you buy this stock? Why or why not?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q34: Which of the following is the best

Q35: Use the following information to answer the

Q36: Use the following information to answer the

Q37: Use the following information to answer the

Q38: Use the following information to answer the

Q40: Assume your existing portfolio is valued at

Q41: Use the following information to answer the

Q42: Use the following information to answer the

Q43: Use the following information to answer the

Q44: Use the following information to answer the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents