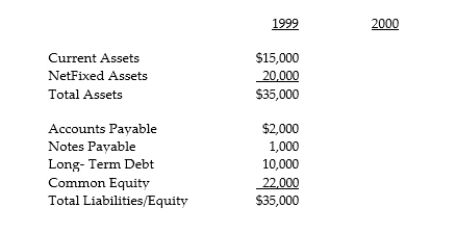

Following is the balance sheet for the end of the year 1999 for Silver Spurs, Inc.:

They have generated sales for 1999 of $35,000 resulting in net income of $15,000. Due to the difficulty associated with acquiring raw materials, Silver Spurs has experienced sluggish business that has caused fixed assets to be underutilized. Management thinks it can double sales next year through the introduction of a new product. No new fixed assets will be required and the dividend payout ratio will be 100%. Assume no additional deprecation expense will be taken in 2000. Project next year's balance sheet in the space provided above to determine the additional funding needed (AFN) for this new product. Assume all current assets and accounts payable will vary directly with sales and notes payable at the end of 1999 are paid off in 2000.

They have generated sales for 1999 of $35,000 resulting in net income of $15,000. Due to the difficulty associated with acquiring raw materials, Silver Spurs has experienced sluggish business that has caused fixed assets to be underutilized. Management thinks it can double sales next year through the introduction of a new product. No new fixed assets will be required and the dividend payout ratio will be 100%. Assume no additional deprecation expense will be taken in 2000. Project next year's balance sheet in the space provided above to determine the additional funding needed (AFN) for this new product. Assume all current assets and accounts payable will vary directly with sales and notes payable at the end of 1999 are paid off in 2000.

Correct Answer:

Verified

Q127: Use the following information to answer the

Q128: Use the following information to answer the

Q129: Use the following information to answer the

Q130: Use the following information to answer the

Q131: Use the following information to answer the

Q133: It has been said that a young

Q134: Producing a sales forecast is primarily a

Q135: General and administrative expenses are an example

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents