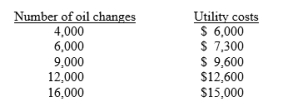

Ace Ventura is considering opening a Kwik Oil Centre. He estimates that the following costs will be incurred during his first year of operations: Rent $6,000, Depreciation on equipment $7,000, Wages $13,700, Motor oil $1.20 per litre. He estimates that each oil change will require 5 litres of oil. Oil filters will cost $3.00 each. He must also pay the Kwik Corporation a franchise fee of $1.25 per oil change since he will operate the business as a franchise. In addition, water and light costs are expected to behave in relation to the number of oil changes as follows:

Mr Ventura anticipates that he can provide the oil change service with a filter at $20.00 each.

Mr Ventura anticipates that he can provide the oil change service with a filter at $20.00 each.

Instructions:

(a) Using the high-low method, determine variable costs per unit and total fixed costs.

(b) Determine the break-even point in number of oil changes and sales dollars.

(c) Without regard to your answers in parts (a) and (b), determine the oil changes required to earn a target profit of $20,000, assuming fixed costs are $28,000 and the contribution margin per unit is $10.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q14: An increase in the unit variable cost

Q15: Break-even sales can be calculated for a

Q16: The break-even point in units for multiple

Q17: The CVP income statement classifies costs and

Q18: Kiwi Ltd manufactures a single product. Annual

Q20: Kelly Hayes operates a bed and breakfast

Q21: Uluru Ltd reports the following results for

Q22: Bondi Ltd had a loss of $100,000

Q23: In 2018, Wollongong Manufacturing had a break-even

Q24: The income statement for Adelaide Ltd for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents