Ellis Ltd accumulates the following adjustment data at 31 December.

1. Revenue of $800 collected in advance has now been earned.

2. Salaries of $600 are unpaid.

3. Prepaid rent totalling $450 has expired.

4. Supplies of $550 have been used.

5. Revenue earned but not yet invoiced totals $750.

6. Electricity expenses of $200 are unpaid.

7. Interest of $250 has accrued on a note payable.

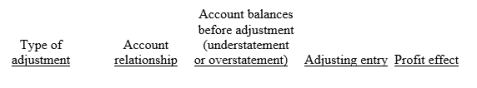

(a) For each of the above items indicate:

1. the type of adjustment (prepaid expense, revenue received in advance, accrued revenue, or accrued expense)

2. the account relationship (asset/liability, liability/revenue, etc.)

3. the status of account balances before adjustment (understatement or overstatement)

4. the adjusting entry.

(b) Assume profit before the adjustments listed above was $16,500. What is the adjusted profit?

Prepare your answer in the tabular form presented below.

Correct Answer:

Verified

Q33: For each of the following oversights, state

Q34: For each of the following oversights, state

Q35: For each of the following oversights, state

Q36: For each of the following oversights, state

Q37: On 31 December 2019, Lance Ltd prepared

Q39: Select the best situation

prepaid expense (PE),

Q40: Select the best situation

prepaid expense (PE),

Q41: Select the best situation

prepaid expense (PE),

Q42: Select the best situation

prepaid expense (PE),

Q43: Select the best situation

prepaid expense (PE),

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents