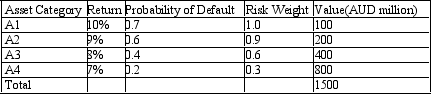

Assume that the bank securitises asset A1. Calculate the risk-adjusted regulatory capital both before and after the securitisation. The table below presents the distribution of assets held by a bank with the associated probabilities of default and rates of return. The regulatory capital ratio is 10%.

A) Before 271.43, After 235.71

B) 27.14, 36.67

C) 271.43, 366.67

D) 27.14, 23.57

Correct Answer:

Verified

Q20: RAROC is:

A) the risk-adjusted rate of return

Q21: Calculate the bank's RAROC. A bank has

Q22: Calculate the risk-adjusted capital ratio. A bank

Q23: Calculate the bank's RAROC. A bank has

Q24: Assume that the bank securitises asset A1.

Q26: Assume that the bank securitises asset A1.

Q27: Calculate the maximum possible loss. The table

Q28: Calculate the maximum possible loss. The table

Q29: Which of the following statements is false?

A)

Q30: The most important feature of the Basel

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents