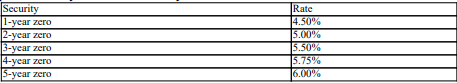

Calculate the market value of the bond based on the above zero coupon yields.You have a 2-year 8% coupon bond with a face value of $100 000 and you are at time zero. Interest is paid annually at the end of the year. ?

A) $111 005

B) $105 615

C) $110 513

D) $97 959

Correct Answer:

Verified

Q30: In the presence of income and capital

Q31: In the presence of income and capital

Q32: A foreign equity investment is preferred to

Q33: A domestic equity investment is preferred to

Q34: An Australian company wishes to invest AUD1

Q35: An Australian company wishes to invest AUD1

Q36: An Australian company wishes to invest AUD1

Q38: The efficient frontier representing domestic securities may:

A)only

Q39: The conventional or domestic CAPM postulates that

Q40: Which of the following is a factor

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents