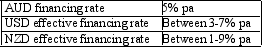

If the firm chooses Australian dollar financing then it is: An Australian firm is faced with the following financing alternatives:

A) risk averse.

B) risk neutral.

C) risk seeker.

D) any of the given answers, depending on the circumstances.

Correct Answer:

Verified

Q8: A depreciation of the domestic currency makes

Q9: An increase in the bid-offer spread in

Q10: A decrease in the bid-offer spread in

Q11: Domestic currency financing is more desirable to

Q12: Foreign currency financing is more desirable to

Q14: If the firm chooses NZ dollar financing

Q15: It is possible to lock in a

Q16: When an Australian firm borrows a foreign

Q17: When an Australian firm borrows a foreign

Q18: The effective financing rate is the foreign

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents