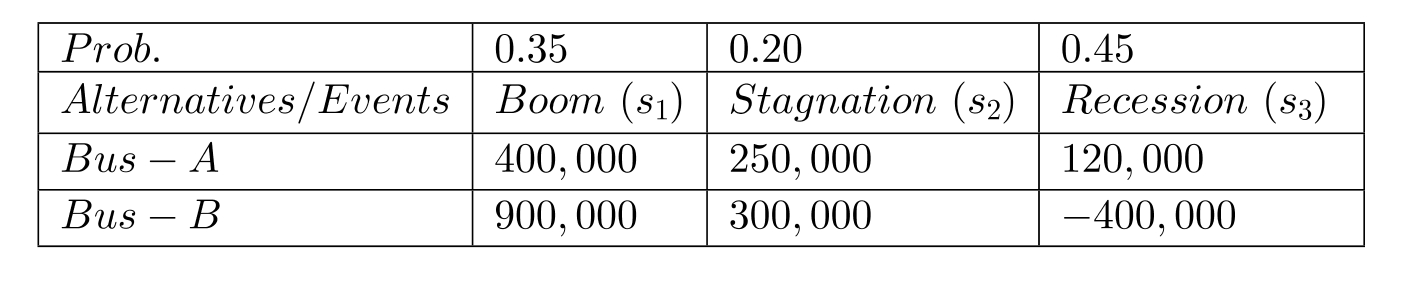

In the following decision problem, you are considering two business opportunities at the end of your business education. One is a safe but less lucrative business (Bus-A) and the other a risky but attractive business (Bus-B). The expected five-year revenue differs significantly depending on boom, stagnation or recession in the national economy. The following table gives the payoff matrix and probabilities.

(A) Draw a decision tree.

(B) What is the best decision maximizing expected monetary value?

(C) What is the expected monetary value?

(D) What is the EVPI?

(E) What is the expected opportunity loss for each decision?

(F) What is the decision that minimizes expected opportunity loss?

Correct Answer:

Verified

(B) EMV(Bus-A)...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q49: Prior probabilities for economic boom, moderate

Q50: Prior probabilities for economic boom, moderate

Q51: Prior probabilities for economic boom, moderate

Q52: Jim Smith is weighing all the

Q53: Jim Smith is weighing all the

Q54: Jim Smith is weighing all the

Q55: Jim Smith is weighing all the

Q56: In the following decision problem, you

Q58: In the following decision problem, you

Q59: Kathy Smith is contemplating her first major

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents