Use the appropriate Tax Rate Schedule below to answer the questions.

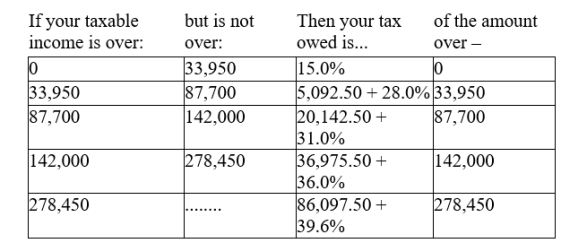

Schedule Z-A - Use if your filing status is married filing jointly

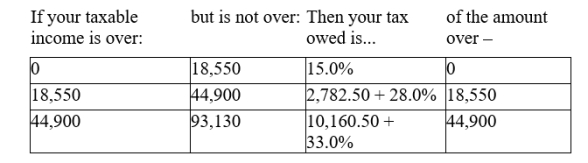

Schedule Z-B - Use if your filing status is single

A) Find the taxed owed by someone whose filing status is single and whose taxable income is $48,000.

A) Find the taxed owed by someone whose filing status is single and whose taxable income is $48,000.

B) Find how much more or less this taxpayer would pay with a flat tax of 20%. If less enter your answer as negative.Round answers to 2 decimal places.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q70: Evaluate the piecewise function. Q71: Choose the graph that best fits the Q72: Use the graph to find the value Q73: In a typical overtime pay scheme workers Q74: Use the appropriate Tax Rate Schedule below Q76: Schiel Construction and Excavating charges a destination Q77: Schiel Construction and Excavating charges a destination Q78: Create a piecewise function to describe the Q79: Create a graph for the piecewise function. Q80: Create a piecewise function to describe the

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents