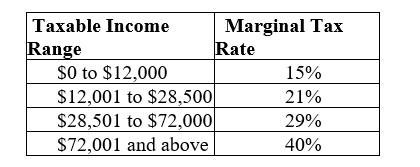

Table 20.3:  The table shows the taxable income range and marginal tax rates for a single taxpayer in Lower Slobbovia.

The table shows the taxable income range and marginal tax rates for a single taxpayer in Lower Slobbovia.

There are no exemptions or deductions on personal income taxes in Lower Slobbovia.

-Refer to Table 20.3. Abner Little is a single taxpayer in the country of Lower Slobbovia who earns an annual income of $80,000. How much income tax will Abner pay, what is his marginal tax rate, and what is his average tax rate? Is this income tax regressive or progressive? How do you know?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q19: In the United States, income taxes are

Q20: In the United States, although people in

Q21: In the United States in 2014, the

Q22: Sabrina is a college professor in Houston,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents